2022 tax brackets

Heres how they apply by filing status. 6 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430.

How Tax Brackets Work 2022 Tax Brackets White Coat Investor

Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

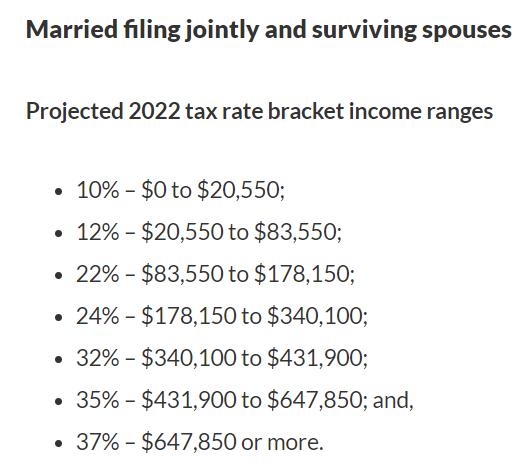

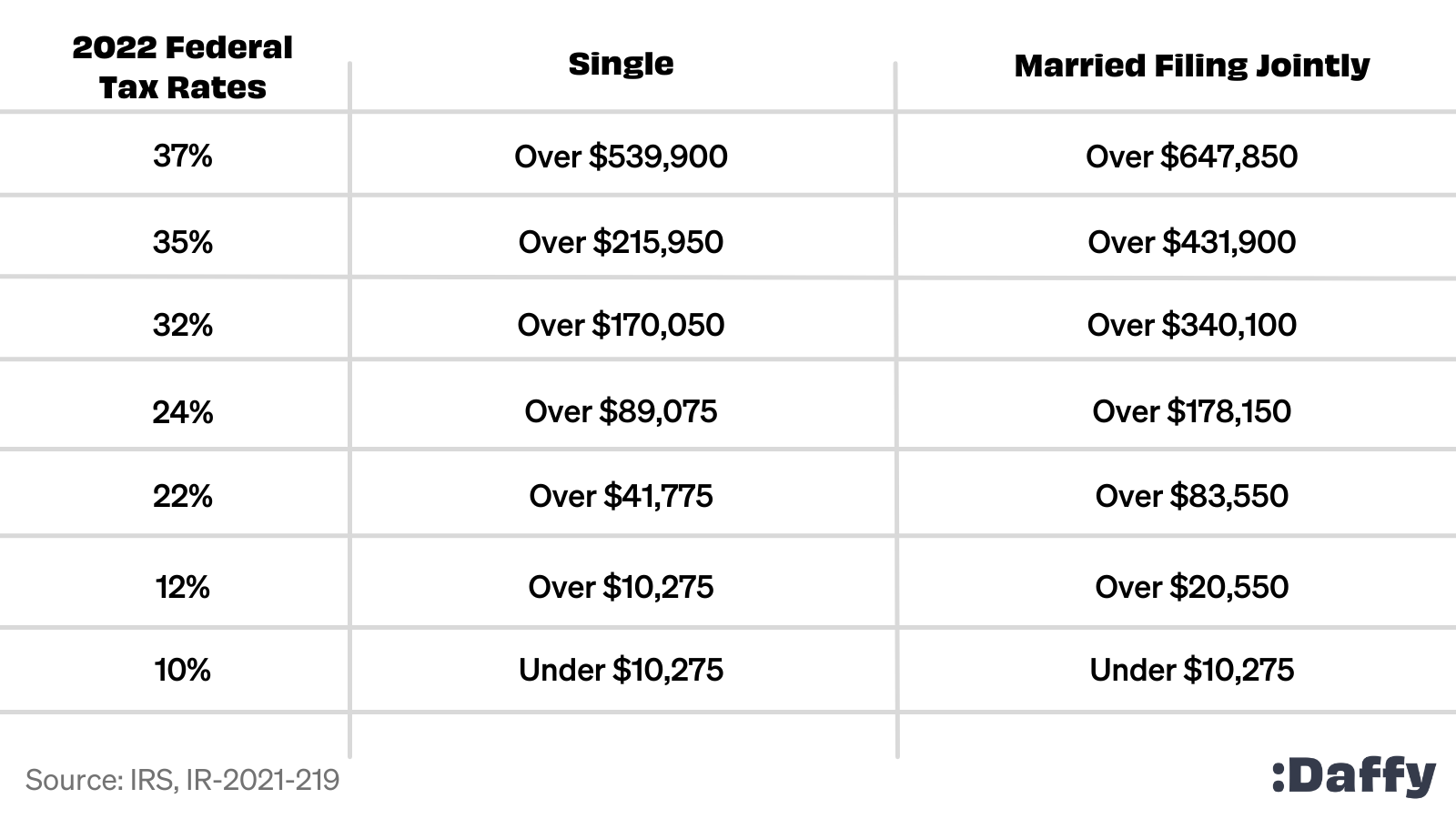

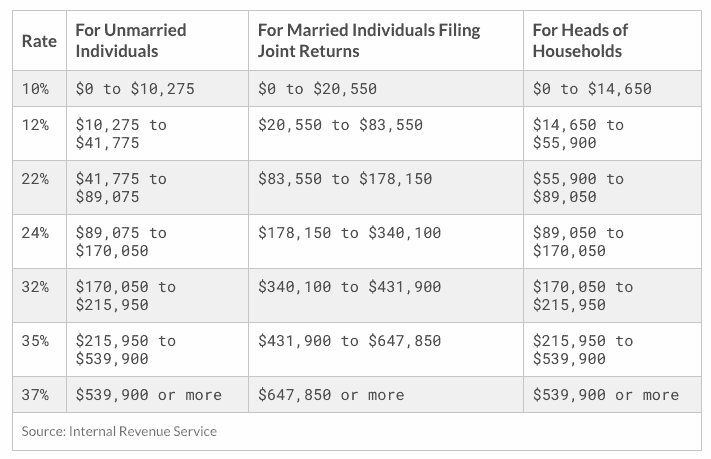

. There are seven tax rates in 2022. 10 12 22 24 32 35 and 37. The federal income tax rates for 2022 did not change from 2021.

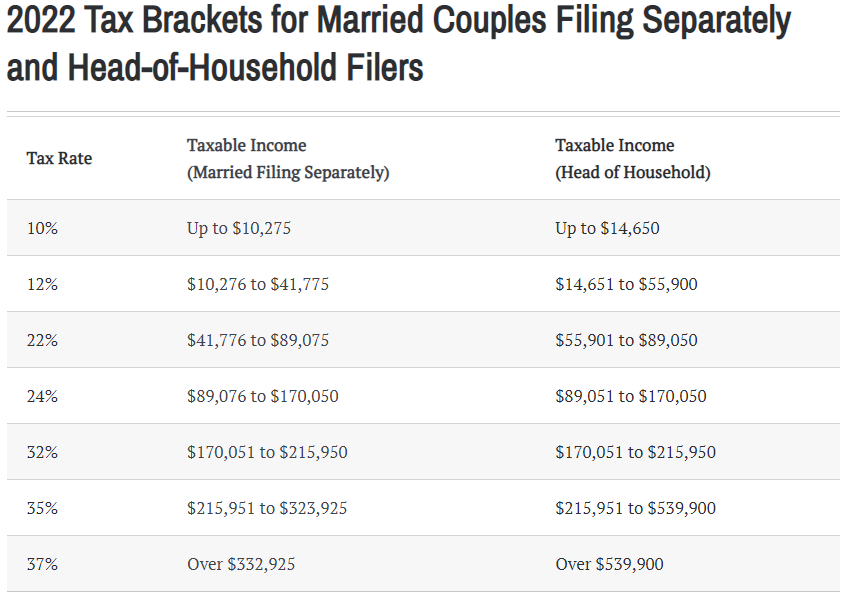

Taxable income between 41775 to 89075. 10 12 22 24 32 35 and 37. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly.

Taxable income up to 10275. 32145 plus 32 of the amount. 35 for incomes over 215950 431900 for married couples filing jointly.

There are seven federal income tax rates in 2022. 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Download the free 2022 tax bracket pdf.

Whether you are single a head of household married etc. 2022 Tax Bracket and Tax Rates. 1420 plus 12 of the amount over 14200.

Tax rate Federal income tax bracket Tax owed. 10 12 22 24 32 35 and 37 depending on the tax bracket. 2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household.

However as they are every year the 2022 tax brackets were adjusted to account for inflation. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. 13293 plus 24 of the amount over 86350.

2022 tax brackets are here. Taxable income between 10275 to 41775. 10 of taxable income.

When it comes to federal income tax rates and brackets the tax rates themselves didnt change from 2021 to 2022. Taxable income between 89075 to 170050. The other rates are.

There are still seven tax rates in effect for the 2022 tax year. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 6220 plus 22 of the amount over 54200.

Federal Income Tax Brackets For 2022 What Is My Tax Bracket

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

Tax Rates Tax Planning Solutions

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

2022 Tax Brackets How Inflation Will Affect Your Taxes Money

2022 Federal Payroll Tax Rates Abacus Payroll

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

The Complete 2022 Charitable Tax Deductions Guide

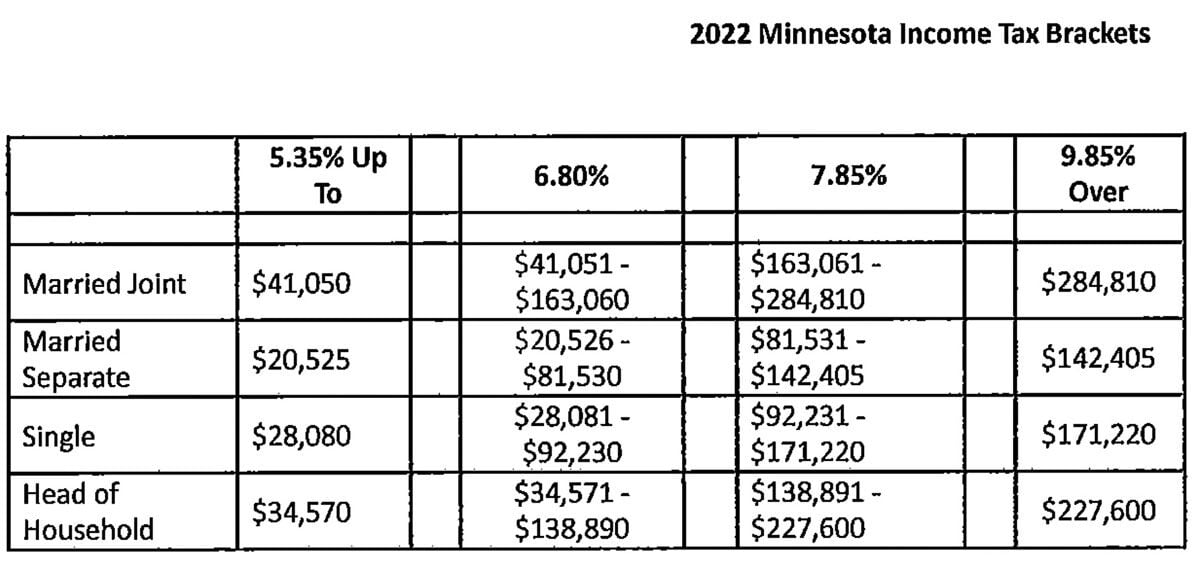

Minnesota Income Tax Brackets Standard Deduction And Dependent Exemption Amounts For 2022 News Walkermn Com

2021 2022 Federal Income Tax Brackets And Rates

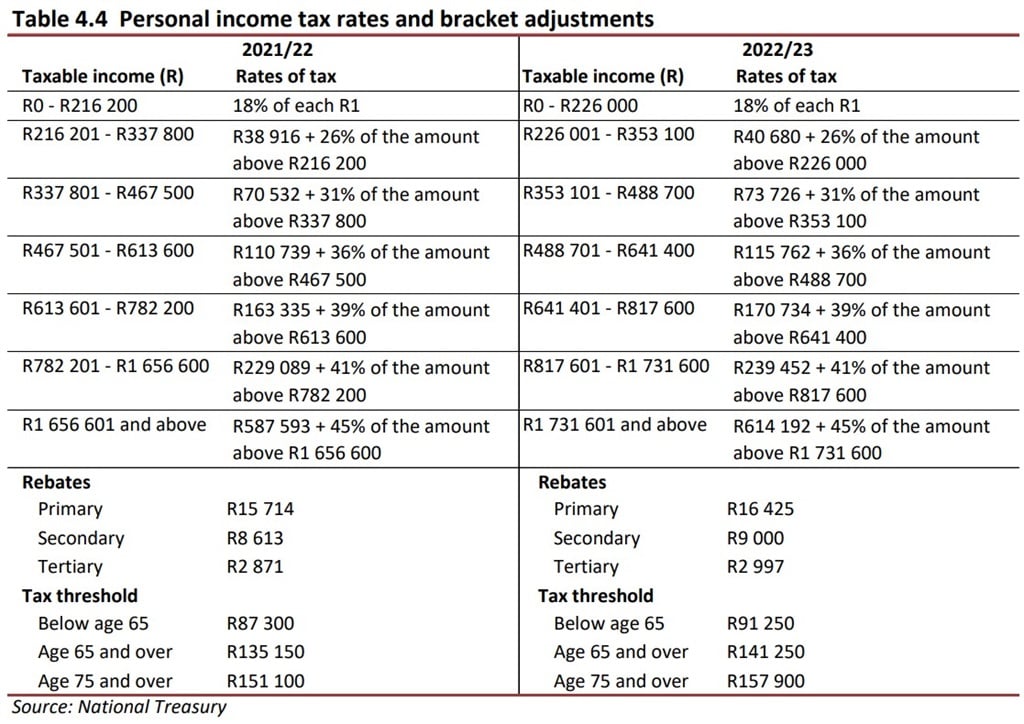

Budget 2022 Tax Relief These Are All The Big Changes Fin24

2022 Trucker Per Diem Rates Tax Brackets Per Diem Plus

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

2022 Tax Brackets And Federal Income Tax Rates Tax Foundation

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation