25+ Roth 401k calculator 2021

If the husband owns 80 or more in the firm with full-time W2 employees and materially participates in the wifes business Single-member LLC then even the single-member LLC cannot have the Solo 401k as the IRS considers both businesses part of a. If you move 100000 from your 401k into a Roth IRA you instantly lose 25 if youre in that tax bracket.

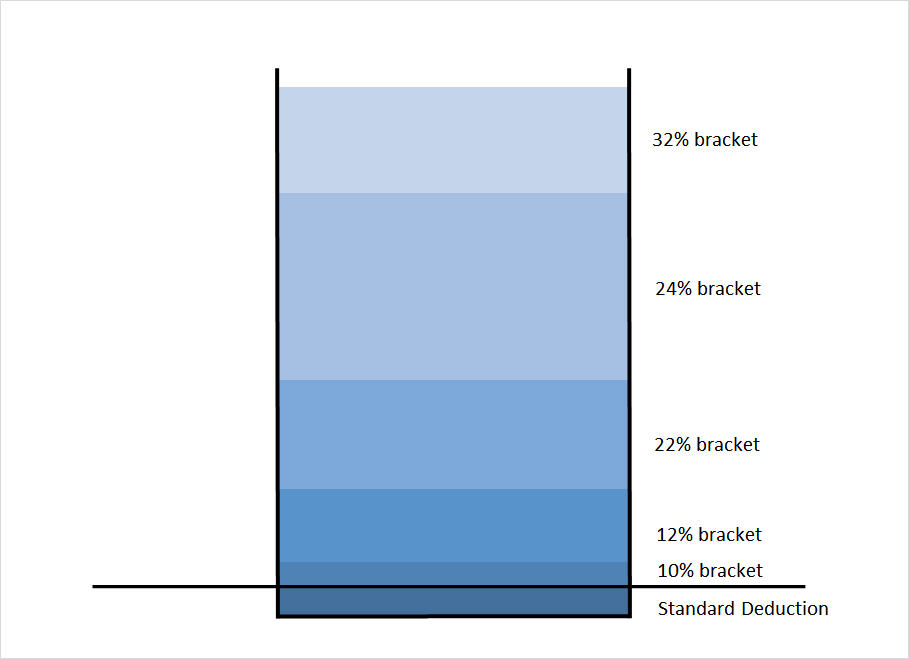

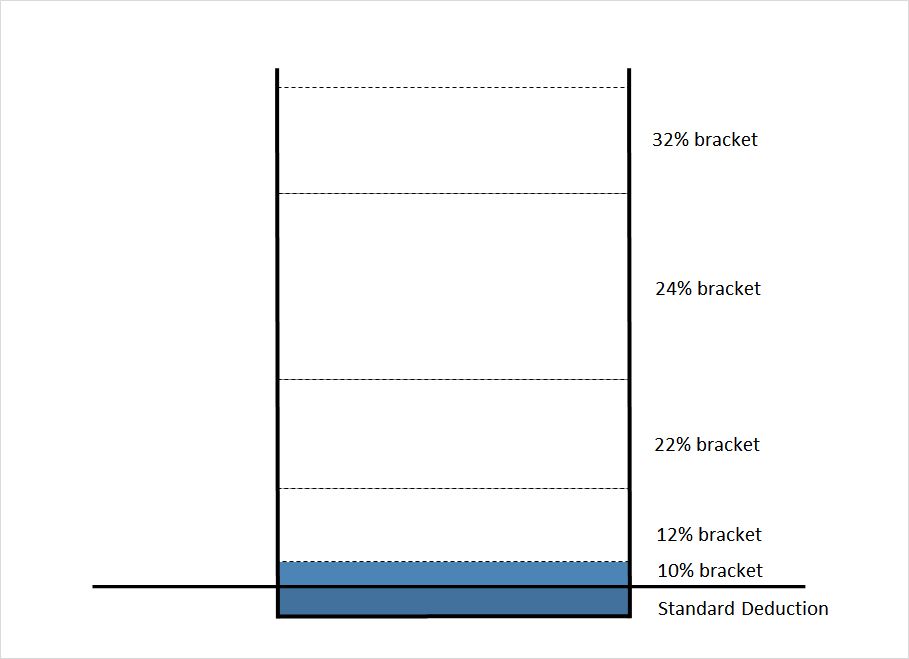

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

Contribution limits for 2021.

/MinimumEfficientScaleMES2-c9372fffba0a4a1ab4ab0175600afdb6.png)

. In many ways the Solo 401k functions like a corporate 401k plan but allows you greater freedom to invest in what you want and contribute on your own schedule because you are your own 401k plan administrator and trustee. 15-Year Vs 30-Year Mortgage Calculator. Total contributions to the plan for 2020 were 38500.

Vanguards 2022 How America Saves report says the average 401k balance for Vanguard participants in 2021 was 141542 up 10 from the 2020 level. Roth IRA A Roth IRA is also a retirement account that you open and fund yourself not through an employer. The maximum 401k contribution for employees under 50 years of age is 20500 in 2022 up 1000 from 2021.

The Solo 401k is a special type of retirement plan for business owners and their spouses. Furthermore to qualify to make Roth IRA contributions filers must have earned income ie. This is the maximum that can be contributed to the plan for Ben for 2019.

When it comes time to stop working you can withdraw funds from the account to pay for your retirement. Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

Average 401k Balance at Age 22-24 27544. A qualified distribution from a Roth IRA meets all the requirements to be a tax-free withdrawal. Roth IRA Calculator.

He deferred 19500 in regular elective deferrals plus 6500 in catch-up contributions to the 401k plan. The money in your 401k is invested in mutual funds exchange-traded funds ETFs or other investments as you choose. Employee and employer contributions cant exceed 61000 or 100 of the employees total pay in 2022.

The 2021 deferral limit for 401k plans was 19500 the 2022. Mortgage Calculator Mortgage Payoff Calculator. 401k former employer Roth 401k.

Accounts included are the following. How is a Roth IRA Different from a Traditional IRA. Additionally as the employer you can make a profit-sharing contribution up to 25 of your compensation from the business up to 58000 for tax year 2021 and the maximum 2022 solo 401k contribution is 61000.

Employees 50 years and older are allowed a 6500 catch-up contribution in 2022 which is unchanged from 2021. For example someone withdrawing from a Roth IRA after reaching age 59½ is making a qualified distribution. Excludes test and invalid accounts.

Snapshotted balance as of 2242022. The amount is increased to an adjusted gross income of 214000 up from 208000 in 2021. However this account is different from a traditional IRA because you contribute after-tax money to it so in retirement you can withdraw your money tax-free.

You can pay this out of your pocket to protect your retirement savings but chances are if youre considering a transaction of this nature you do not have that kind of money lying around. Thats 25000 you owe the taxman. His business contributed 25 of his compensation to the plan 12500.

A Roth IRA and a 401k are two types of retirement accounts with one big difference in how they are taxed. The maximum SEP IRA contribution is the lesser of 25 of adjusted net earnings or 58000 for 2021 61000 for 2022. For 2021 and 2022 6000 per year 7000 per year for those age 50 or older.

An exception to this though is a Roth 401k which you fund with after-tax money. Qualified distributions also include withdrawals at any age that go toward buying building or repairing your first home. And the standard service tier charges a competitive annual fee of 025 of your assets under management.

Average 401k Returns Dont Tell the Whole Story. The key difference between a Roth IRA and a traditional IRA has to do with how and when you are taxed. With a Roth IRA contributions are made from.

The IRS contribution limit increases along with the general cost-of-living increase due to inflation. YES the husbands ownership percentage in the separate firm matters. Excludes any account value greater than 100000000 or less than -100000000.

Money in a traditional 401k or IRA grows tax deferred meaning that you pay taxes on the money when you withdraw the funds and no taxes at all when you invest the money. Solo 401k plans also allow you to make post-tax Roth contributions. However this number cant really tell you much.

Great question Anthony. Retirement Calculator Investment Calculator Net Worth Calculator Home Buying and Selling. Salary Deferral Contribution In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can be contributed to a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. 6000 or 7000 if you are over 50 years old. Mark Henricks Apr 25 2022.

This is the type of contribution that can be made as pre-taxtax-deferred or Roth deferral or a combination of both.

Roth Ira Vs Traditional Ira Roth Ira Investing Traditional Ira Personal Finance Quotes

The Case Against Roth 401 K Still True After All These Years

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Contribute To My 401k Or Invest In An After Tax Brokerage Account

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-01-acdb55c99d224a48afe733fe552c796e.jpg)

Options Basics How To Pick The Right Strike Price

Net Asset Formula Examples With Excel Template And Calculator

:max_bytes(150000):strip_icc()/dotdash_Final_Options_Basics_How_to_Pick_the_Right_Strike_Price_Feb_2020-04-3d62440d22b8498684ee7f7773b52c07.jpg)

Options Basics How To Pick The Right Strike Price

The Case Against Roth 401 K Still True After All These Years

The Benefits Of A Backdoor Roth Ira Financial Samurai

401k To Roth Ira Conversion Rules Taxes Limits

/MinimumEfficientScaleMES2-c9372fffba0a4a1ab4ab0175600afdb6.png)

Minimum Efficient Scale Mes Definition

Depreciation Rate How To Calculate Depreciation Rate With Example

New Jersey Secure Choice Faqs Fisher401k

The Case Against Roth 401 K Still True After All These Years

Ebit Calculation Examples Of Ebit Earnings Before Interest And Taxes

Operating Cash Flow Formula Examples With Excel Template Calculator

The Benefits Of A Backdoor Roth Ira Financial Samurai